Work and Wealth

Who wants to be a millionaire?

Getting Rich

Who doesn’t want to be a millionaire? Imagine retiring from work, travelling the world at your leisure in a private jet and being served cocktails in a hammock on a tropical beach. Sound too far out of reach? Do you think the millionaire club is ultra exclusive and you wouldn’t be able to make it an achievable goal?

Well according to this CNBC article there are 14.6 million people around the world who have an investable fortune of USD $1 million or more. This puts you in the top 1-2% of the wealthiest people in your country. It sounds impressive and nearly impossible, right? Not so.

To get there you need to figure out a strategy to get you that one million investable dollars. There are three basic ways to achieve the million dollar goal, you can scrimp and save your way there, hope and pray the millions appear or you can earn and invest to make the millionaire club.

Today is the first of three posts that will explain these options.

Scrimp and Save

The most basic method to become a millionaire is to scrimp and save your way there, which is the option for anyone and everyone with the time to let the strategy work. You don’t need be a business guru, nor speculate on stocks or learn about complicated financial products. All you need is commitment to the strategy, time on your side to let it play out and truly believe in the simple secret of its success….. work hard, save and don’t overspend.

Now using this method won’t turn you into a millionaire overnight, but your financial goal will be achieved over the course of years. In fact it is mathematically guaranteed to work. That’s right, it can be proved mathematically that you can become a millionaire by adopting three straightforward steps. How simple you ask? Well all you need to do is be committed to these three requirements:

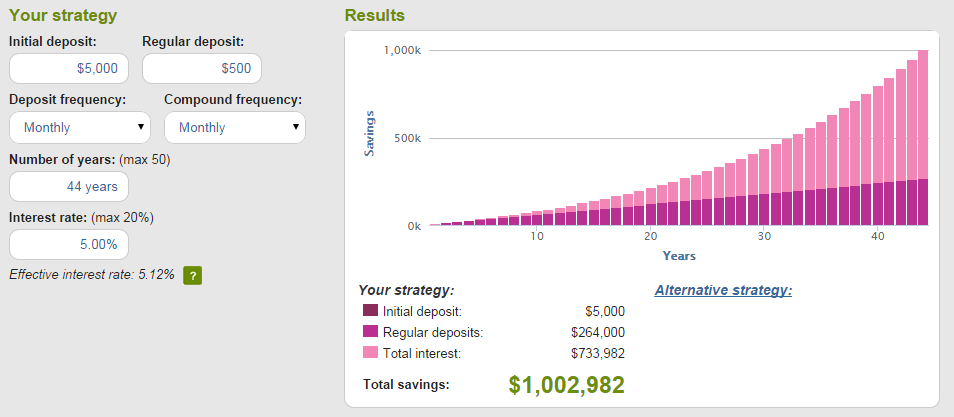

- Start with $5,000 in the bank

- Save $500 per month throughout your lifetime

- Earn an average of 5% on the savings

That’s it, three simple requirements to be mathematically certain of becoming a millionaire. So, what’s the catch? You need a lot of time on your side as it’ll take 44 years to reach the goal. If you started when you were 20 then at 64 you would have that one million investable dollars and be perfectly timed to retire without any financial worries. The other catch is that such a long period of time will require a true belief in the strategy, dedication to working hard to earn income and an unwavering commitment of not overspending in order to save the $500 each month.

So how does this strategy work? It’s quite simple, it’s based on the phenomena that is very simple but so often overlooked: compounding interest. Below is a chart of our scrimp and save strategy, what you see is that in the early years, the main contributor to the total balance are the deposits/savings (dark purple) from the $500 monthly. As the years grow the monthly savings slowly become less of the total and the interest grows and grows becoming nearly three quarters of the one million dollar balance. How amazing is that? You’ve saved $264,000 over those 44 years but the interest at only 5% per annum has been working even harder than you have and now worth approximately $734,000.

Source: Moneysmart.gov.au

This truly is a method that anyone can implement by taking two steps, first turbo charge your finances by reading my last post and then follow the three simple requirements above. Before you know it you’ll be a member of the millionaires club. Cocktail, anyone?

Check back in next week for strategy #2

Remember to like us on Facebook

And follow us on Instagram and Twitter @merrygoround_au

Comments

Tyson works as a Chartered Accountant. When he isn’t chained to the desk he enjoys running, shooting hoops or spending far too much time studying fantasy sports. Tyson is a father, sports fan and co-founder of Brewers Feast a Melbourne craft beer and food festival.

0 comments