Work and Wealth

Do you understand your financial web?

How many different bank, savings, brokerage accounts and credit cards do you have? Would it be five or six? Maybe a dozen of so? If you’re like me, you’ll have more usernames and passwords to remember than seems necessary to function each day. No wonder trying to manage your finances can become too difficult.

Do you know which account receives your income and which pays your bills?

Which one is used for savings?

What does your paypal account do for you and which account and credit card is it linked to?

Which credit card do you use for bills?

Is there another credit card or travel card for overseas holidays?

Head spinning, yelling close the browser now? Take a deep breath and then keep reading.

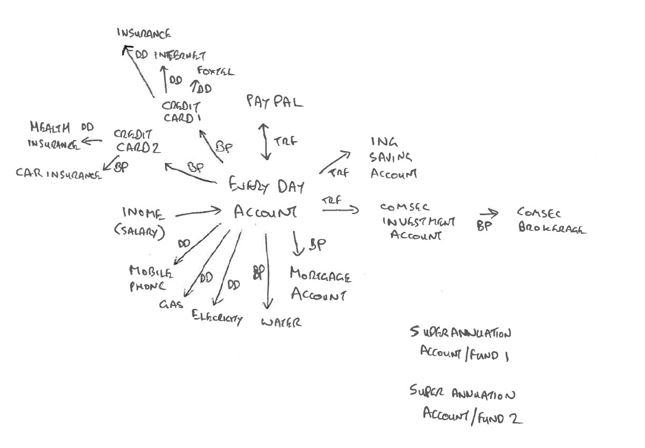

Many people have a spider web of accounts and cards making them feel like a fly trapped in the middle. To untangle this web the easiest way is to create a map to show the flows and connections by capturing all your accounts and what inflows and outflows of each.

Understand your financial web

Start with all your accounts – bank accounts, savings accounts, brokerage accounts, credit cards, paypal, superannuation accounts, mortgages, loans, etc. Make sure to really go through the archives of your financial history to make sure that savings account opened five years ago with ‘good intent’ that now sits empty and idle is included in your map. Basically, if you closed all your accounts what receipts wouldn’t you receive?

Now add to the list all your regular income and expenses or subscriptions. Write down your income sources covering your salary, interest, investment income, etc. Then list all your expenses or direct debit payments. This may be mobile phones, internet, utilities, mortgage repayments, paytv/netflix, etc. Basically if you closed all your accounts what payments would ‘bounce’?

Map out your finances

Let’s get artistic by drawing arrows between the accounts to show the connection between accounts and the inflow/outflow items. The arrowhead should indicate the flow and use an acronym for the link type, TRF for Transfer, BP for Bill Payment and DD for Direct Debit.

Now that you’ve mapped out all of your accounts, how much of a spider web does it look like? Is it more or less complicated than you imagined?

Simplify your financial web

The next step is to simplify your accounts and finance web. This means cutting inactive accounts, consolidating credit cards and accounts to reduce the number you have. For superannuation if you have multiple accounts look to roll funds into a single account. For savings accounts seek the highest earning account.

For each account to be removed from your map circle it, once closed cross it off. Having a clear goal (removing those circled accounts) and awarding yourself for each cross, will keep you motivated and give you the visual feedback to keep going.

Once you’ve achieved every cross it’s time to redraw the map, the simplified map. This new map is now the simpler financial world you now live in, keep it handy as your roadmap to managing your finances.

Connect with us on Facebook, Instagram and Twitter

And also follow us on Pinterest

Comments

Tyson works as a Chartered Accountant. When he isn’t chained to the desk he enjoys running, shooting hoops or spending far too much time studying fantasy sports. Tyson is a father, sports fan and co-founder of Brewers Feast a Melbourne craft beer and food festival.

0 comments