Work and Wealth

What fortune is your personal balance sheet telling you?

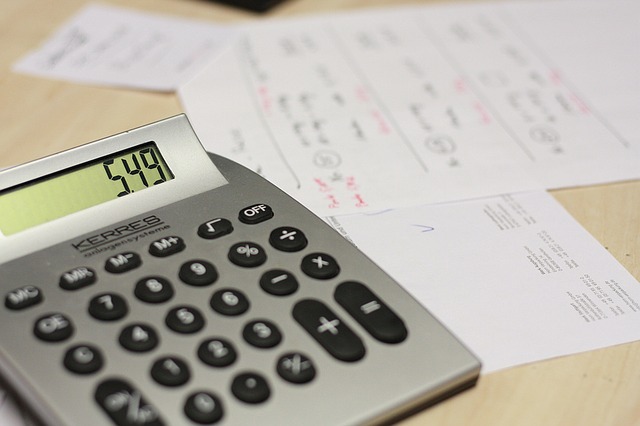

While having a personal balance sheet is a useful tool to have, the real impact is in understanding what it means so you can take action in setting the right financial goals. In the last article Calculating your Net Worth we went through the basics of a personal balance sheet and completed an exercise to calculate your personal wealth.

The first thing you should understand from this exercise is that you have now identified what ‘restrictions’ you have on being financially free. Generally that will be the debt you hold, the larger it is the more you’ll be held back from achieving financial freedom. At the center of every bankruptcy is one simple factor, debt. There is no new way to go broke, it has always been the same source, debt. Whether it is housing loans, credit cards, even phone, electricity or water bills (this is a ‘form’ of debt), the problem is that debt will be the sole cause of financial stress and in the worst case, bankruptcy.

Have you calculated your personal wealth?

Let’s re-visit your personal balance sheet we created last time to start understanding your overall position.

If you’re net worth is negative this is most likely due to debt, that is your assets are funded by debt and your financial actions and goals should almost be solely focused on reducing the debt as quickly as possible to get into a positive net wealth position.

If your net wealth is positive, congratulations your assets are worth more than you’re debts. To further understand your net wealth, let’s assess by taking your house (or houses) out of the total assets amount but don’t adjust the liabilities.

Recalculate the total assets and total position, is it still positive? If yes, that’s most likely because you’ve paid down a substantial amount of your house debt and/or you’ve experienced capital grow. This position will allow you to have some freedom on what financial goals you should set.

If your net wealth in this revised calculation is negative, this means the majority of your debt is most likely related to your house. Again this means your financial actions and goals should be focussed on reducing the debt as quickly as possible.

If we haven’t lost you yet and you’re still reading this far, well done this can sometimes be a difficult and challenging exercise to complete, you’ve not only had to assess your financial position, perhaps revealing some unpleasant truths or perhaps you’ve uncovered some positives being taken for granted. Perhaps the financial goals you had envisioned (a holiday or new car) don’t align right now with what the personal balance sheet is telling you (reduce debt).

By taking the steps to create a personal balance sheet has meant you’ve measured your current financial position. By assessing its meaning, the direction of financial goals are made clear, it narrows your focus to set goals which improve your personal balance sheet. This is the foundation from which priorities and actions can be taken, your first step on the journey to being wealthy and financially free has begun.

Make those steps to being financially free today!

Comments

Tyson works as a Chartered Accountant. When he isn’t chained to the desk he enjoys running, shooting hoops or spending far too much time studying fantasy sports. Tyson is a father, sports fan and co-founder of Brewers Feast a Melbourne craft beer and food festival.

0 comments